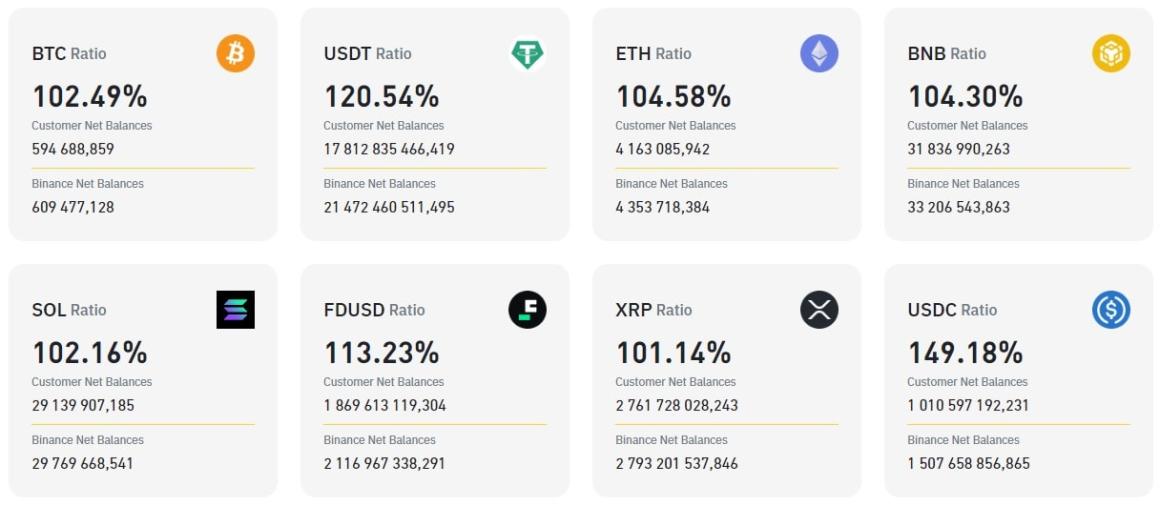

Binance has recently completed another audit of the reserves held on its platform. As of 7 February 2024, the trading platform controls 609,477 BTC and 4.35 million ETH.

Binance customers, on the other hand, hold 594,688 BTC and 4.16 million ETH. This means that the safety of customer funds in bitcoin and Ethereum is 102.49% and 104.58% respectively.

The safety of customer funds in #USDT stablecoin exceeds 120%, while funds in #BNB tokens are 104.3% secured. Also worth noting is the high level of asset security in #USDC steiblcoins, which exceeds 149% according to Binance's report.

Compared to the January report, there is a significant decrease in client funds held in BUSD stablecoins. Meanwhile, Binance's own collateral in this asset reached 587%.

Recall that in December, Binance removed BUSD from its platform and urged users to convert it to other assets.

In addition, the exchange has TUSD and FDUSD stablecoins on its balance sheet, with reserves of 112% and 113%, respectively.

Proof of Reserves refers to information about the custody of client assets. Binance first introduced this concept in November 2022, following the FTX bankruptcy, to demonstrate its ability to fulfil customer withdrawal requests.

In February 2023, Binance released an update to the Proof of Reserves system, making the audit process more efficient and transparent.