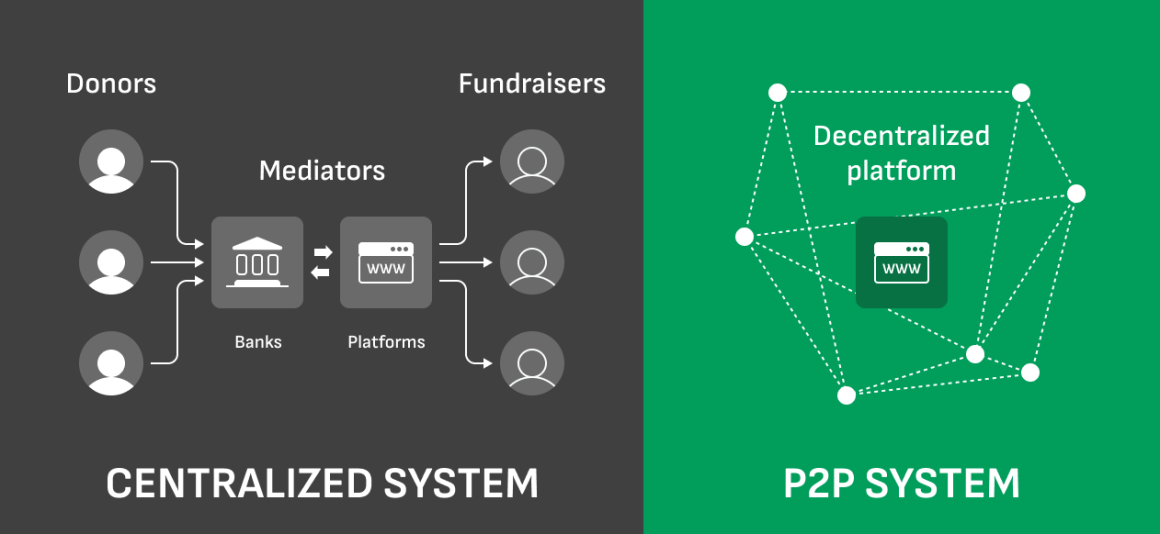

Fundraising has long been dominated by traditional methods—banks, venture capitalists, and crowdfunding platforms — all of which come with their own set of challenges, like high fees, geographic limitations, and lack of transparency.

But with the rise of decentralization and platforms such as UFANDAO, a new and more inclusive way of fundraising has emerged. By leveraging technologies like blockchain, decentralized platforms have made it possible for anyone, anywhere, to raise funds directly from their community without intermediaries.

Today, we explore how decentralization is reshaping the fundraising landscape, making it more accessible, transparent, and empowering for both fundraisers and contributors. We’ll dive into the core concepts of decentralized fundraising, discuss the problems it solves, and look at the many benefits it offers.

But first, let’s start with a key question: what exactly is decentralization, and why does it matter in fundraising?

Understanding Decentralization in Fundraising

Decentralization changes the game for fundraising by shifting control from traditional gatekeepers, like banks, venture capitalists and fundraising platforms, to the wider community. In this context, no single entity decides who can raise money or how funds are distributed. Instead, fundraising becomes more open, transparent, and accessible.

- Blockchain is a key example. It allows fundraisers to collect contributions directly from supporters, without needing a third-party platform to manage transactions. Each contribution is recorded on a decentralized ledger, ensuring transparency and security.

- Decentralized finance (#DeFi) takes it further by enabling fundraising without traditional banks. Fundraisers can issue tokens, raise capital, and distribute rewards, all through smart contracts that automatically execute based on pre-agreed conditions.

- Decentralized Autonomous Organizations (#DAOs) bring community-driven fundraising to life. In a DAO, contributors often get a say in how funds are used, typically through token-based voting. This gives backers more involvement in the project and creates a sense of shared ownership, which isn't common in traditional fundraising.

We’ll explore some of the benefits of cutting out intermediaries later on, but for now, let’s explore the problems that decentralised fundraising solves.

Challenges in Traditional Fundraising

Traditional fundraising is full of roadblocks that can make it tough for a wide range of projects, from startups to charitable causes, to gain traction.

One of the biggest challenges is the high costs and regulations involved. Whether you're raising money through venture capital (VC), launching an IPO, or organizing a large-scale charity event, the process typically requires costly legal, marketing, and administrative work. These overheads can drain resources, especially for smaller organizations or community-driven causes. Barriers to entry also extend to individuals looking to raise for personal goals.

#Crowdfunding may appear to be a more accessible route, yet even platforms like Kickstarter or GoFundMe come with hefty fees, and running a successful campaign often comes with hidden expenses. This can be particularly difficult for charities and non-profit initiatives where every dollar matters.

Geography and economic disparity also create barriers. In traditional fundraising, access to capital or donations is often linked to location and network. A startup in Silicon Valley might have a better shot at securing VC funding, while a nonprofit in a smaller, less connected community could struggle to attract donors or investors. Similarly, economic inequality means wealthier regions have more opportunities to connect with financial backers, while those in developing or underserved areas face greater challenges.

Lack of transparency is another widespread issue across different forms of fundraising. Whether it’s a startup or a charitable project, contributors often have limited visibility into how their funds are used. Donors or investors place trust in the fundraiser’s promises but are left without much control or oversight. For fundraisers, meeting regulatory requirements and appeasing investors or donors can restrict flexibility and slow down progress.

These obstacles create an environment where only a few high-profile initiatives or well-connected causes can succeed, while many other valuable projects struggle to gain the necessary resources. The traditional fundraising landscape is often slow, costly, and exclusive, making it difficult for a diverse range of ideas and causes to thrive.

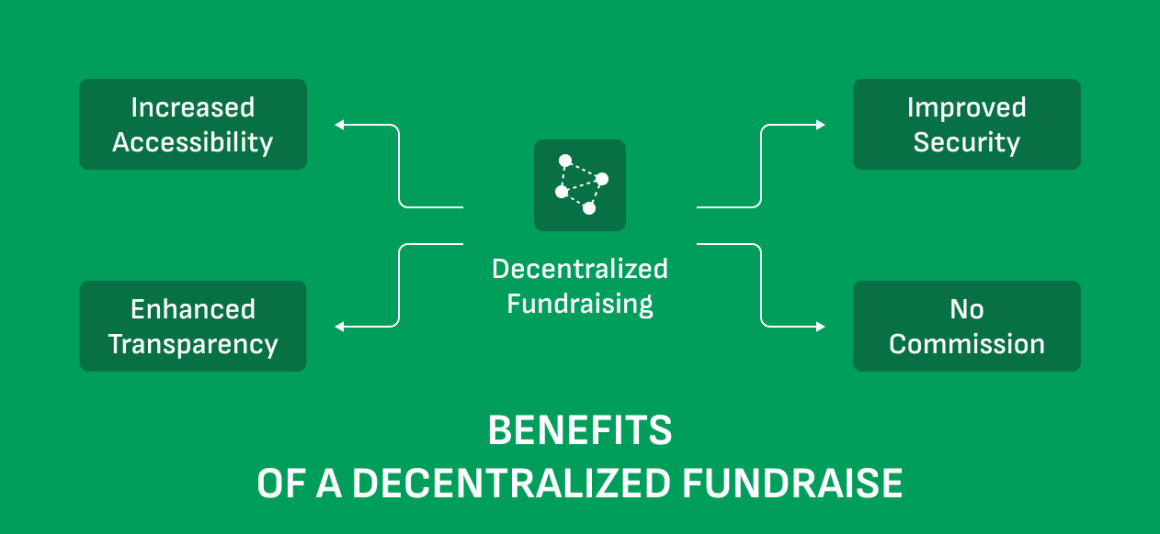

Key Benefits of Decentralization in Fundraising

Decentralization unlocks several key benefits that traditional fundraising models can’t match, transforming how projects and people raise and manage funds.

- Global Reach and Accessibility

Decentralized platforms give fundraisers access to a truly global pool of contributors. Instead of relying on local networks or specific investors, anyone with an internet connection can participate. This breaks down geographic barriers, making it easier for fundraisers from any part of the world to tap into resources.

Whether you're in a major city or a remote village, decentralized fundraising opens doors that traditional methods often keep closed. - Lower Costs and Fees

One of the most attractive features of decentralized fundraising is the significant reduction in costs. Traditional fundraising often involves banks, legal teams, and middlemen who each take a cut, driving up expenses.

In contrast, decentralized systems typically operate with minimal or no intermediary fees. Transactions happen directly between the fundraiser and the contributors, using blockchain or DeFi platforms to handle transfers at a fraction of the cost. This allows more of the raised funds to go directly toward the project rather than being eaten up by overheads. - Transparency and Trust

Transparency is built into decentralized fundraising through the use of smart contracts and immutable records. Smart contracts automatically enforce the terms of the fundraising, ensuring that funds are only released when certain conditions are met.

These contracts are visible to everyone, as are the records of each transaction, creating a level of accountability that’s hard to find in traditional systems. Contributors can track exactly where their money is going in real-time, building trust and confidence in the project.

Additionally, decentralized governance gives contributors a voice. Many decentralized projects allow backers to vote on key decisions, which fosters a sense of shared ownership and trust. - Empowering Contributors

Decentralized fundraising doesn’t just benefit fundraisers — it also empowers contributors. Through tokenized ownership, contributors can have a direct stake in the project.

This goes beyond just financial support; they often gain voting rights or influence over the project’s direction (or an individual’s dream, for example). It transforms passive donors into active participants, which helps build a strong, engaged community around the project.

Indeed, decentralization democratizes fundraising, making it more accessible, transparent, and collaborative for everyone involved.

Decentralized Fundraising in Action

Decentralized fundraising is already proving its value in the real world, with several high-profile projects showcasing its potential.

One notable example is ConstitutionDAO, a decentralized autonomous organization that raised over $40 million in cryptocurrency to bid on a rare copy of the U.S. Constitution. Although the group didn’t win the auction, the campaign demonstrated how quickly decentralized platforms could rally global contributors.

Initial Coin Offerings (ICOs) have also been a popular method of decentralized fundraising. Companies like Ethereum and Tezos raised millions by issuing tokens to early backers in exchange for cryptocurrency. These tokens often represent a stake in the project, giving contributors more than just a return on their investment; they get a voice in the project's development.

Another growing trend is NFT-based fundraising, where creators sell unique digital assets to raise funds. This approach has been particularly successful in the art world, with artists like Beeple raising millions through #NFT auctions. Decentralized fundraising models like these are innovative because they cut out traditional financial intermediaries and give both creators and backers more control.

Lastly, projects such as UFANDAO are leveraging decentralisation to offer peer-to-peer donations without intermediaries. By enabling aspects such as cryptocurrency payments, these initiatives can be accessible to anyone around the world, with very few barriers to entry.

Risks and Considerations

While decentralized fundraising offers many advantages, it’s not without risks. One major concern is security. Decentralized platforms can be vulnerable to hacks and scams, as seen in high-profile incidents like the DAO hack in 2016, where attackers exploited a vulnerability to steal $60 million worth of cryptocurrency. Smart contracts are powerful tools, but poorly written code can be manipulated, leading to potential losses.

Another challenge is regulatory uncertainty. Governments around the world are still figuring out how to #regulate decentralized fundraising, particularly in cases involving cryptocurrencies and token sales. Fundraisers must navigate an evolving legal landscape, where compliance can be unclear and the risk of violating regulations is high.

Finally, there’s the issue of volatility in cryptocurrency-based fundraising. Cryptocurrencies can experience significant price swings, which can affect both the amount raised and the value of funds once they’re collected. Managing this volatility requires careful planning to ensure that funds are stable enough to be used as intended.

To mitigate the risks and concerns in decentralized fundraising, fundraisers should prioritize using secure, audited smart contracts to prevent vulnerabilities and ensure safety.

Also, partnering with reputable platforms that have a track record of managing decentralized campaigns can also reduce exposure to hacks and scams.

Lastly, using #stablecoins or hedging strategies can help manage the volatility of cryptocurrency, ensuring that the funds raised retain their value and are ready to be deployed as planned.

Indeed, while there are risks, there are strategies for mitigation that should also be considered.

The Future of Decentralized Fundraising

Looking ahead, decentralized fundraising platforms such as UFANDAO are likely to grow in popularity as more people and projects embrace the benefits they offer.

Traditional fundraising models may need to adapt to this shift or risk becoming obsolete. We might see hybrid approaches, where centralized platforms incorporate decentralized features like smart contracts or tokenized ownership to stay competitive.

Decentralization will continue to make fundraising more inclusive and innovative, breaking down barriers and offering opportunities to those who were previously excluded from the global financial system.

The future of fundraising could be more democratic, transparent, and community-driven than ever before.