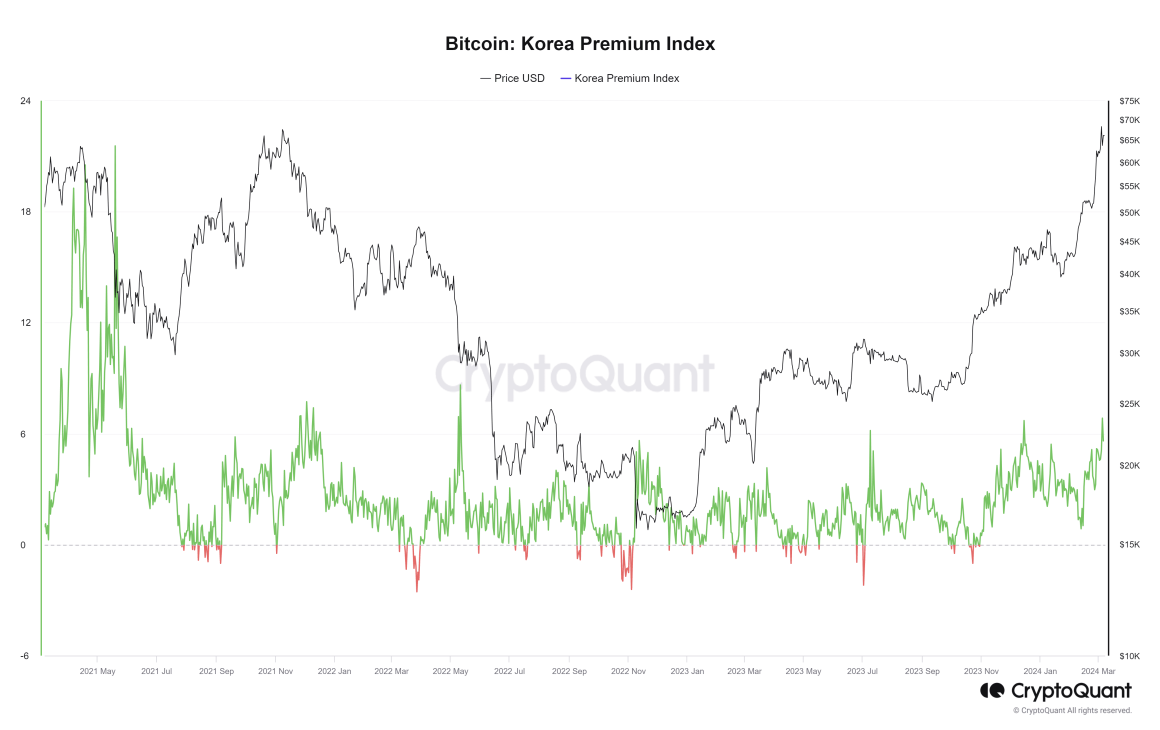

In South Korea, the "kimchi premium" index has reached its highest value since May 2022, as CryptoQuant reports that the index has now soared to 10.32%.

The "kimchi premium" refers to the discrepancy between the price of bitcoin in South Korea and its valuation in the global market. This discrepancy is caused by the unique characteristics of the local cryptocurrency sector and financial system. As a result, market participants are unable to normalize prices or arbitrage transactions.

On March 5, 2024, the exchange rate of major cryptocurrencies reached an all-time high (ATH), surpassing the $69,000 mark. At the same time, the value of bitcoin reached US$72,926 in the Korean market.

The #bitcoin exchange rate then fell sharply, temporarily dropping to US$59,000. Currently, according to TradingView, the bitcoin price is holding at 67,000 USD.

Experts emphasize that the growth of the Kimchi Premium Index reflects the surge in demand for digital assets in South Korea. The influx of private investors is putting pressure on the price differential.

Earlier we reported that El Salvador made a profit of more than $65 million on the back of a sharp rise in the bitcoin exchange rate.