Futures trading is usually demonized by many people, but futures is an excellent tool to make profits. Experienced traders know this.

If you are just learning how to trade, you need to think of a strategy that you will use in your futures trading. Strategy is one of success keys in your journey as a trader.

Most popular futures trading strategies

Futures #trading strategies vary widely depending on risk tolerance, market conditions, and financial goals. Here are top 5 strategies that you can consider for yourself:

1. Trend Following: This strategy aim to profit from existing market trends. Traders identify trends using technical analysis tools, enter trades in the direction of the trend, and exit when signs of reversal appear. The strategy focuses on momentum, use of risk management techniques, diversifying across assets, systematic rules, and adaptation to changing market conditions.

Trend followers are not trying to predict tops and bottoms. They are not trying to predict anything, really. The aim is, quite simply, to take advantage of moves in different asset classes in the anticipation that some of the positions go their way big time. There is zero forecasting involved.

Trend followers might use different time frames and many asset classes to diversify in order to avoid big drawdowns.

2.Spread Trading: Spread trading is a type of market-neutral strategy that involves simultaneously opening two positions: one long and one short. The aim is to profit from the change in the price difference between the two positions, rather than the direction of the market.

Spread trading can be applied to crypto futures in two ways: cross-asset spreads and calendar spreads. Cross-asset spreads involve trading futures on different cryptocurrencies or their perpetual futures, such as #BIT/BTC or BIT/USDT. Calendar spreads involve trading futures on the same asset but with different maturities, such as BTC March 2023 and BTC June 2023.

3. Swing Trading: Swing trading is a popular strategy in the cryptocurrency market that involves holding positions for several days to weeks to capture short- to medium-term price movements.

Crypto swing traders analyze price charts and market trends to identify potential entry and exit points. They aim to capitalize on market volatility, entering trades at the start of a price movement and exiting before it reverses. This approach allows traders to capture gains from the natural ebb and flow of the market without needing to monitor their positions constantly.

4. Day trading: Day trading is a popular strategy where individuals buy and sell crypto within the same trading day. Day traders depend on identifying market trends and technical analysis to guide their crypto day trading strategies.

Although day trading appeals to those looking to make quick gains, it can also lead to losses during highly #volatile markets.

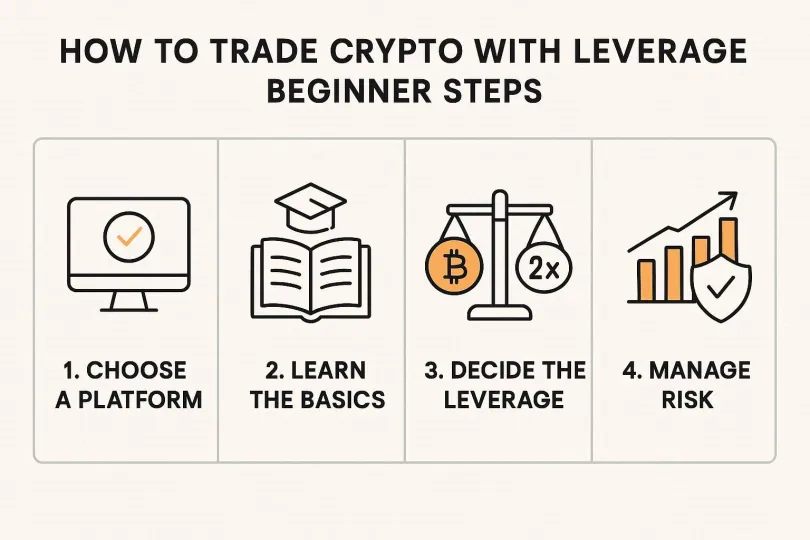

Crypto day trading is often accompanied by the use of leverage, which has the power to amplify profits and losses.

5. Scalping: Making a lot of small trades to profit from little price movements is known as scalping. Scalpers take advantage of inefficiencies in the market by holding for extremely little time—sometimes even a few seconds. This tactic necessitates making decisions quickly and having a sharp eye for passing up opportunities.

For traders who can constantly execute transactions precisely, scalping can be quite rewarding. However, it also demands significant time and attention, and a solid grasp of market dynamics and trading platforms.

6. Arbitrage: Arbitrage trading advantages from the price differences between different exchanges or markets. This means that traders purchase crypto at a lower price on one exchange and sell it for a higher price on another, profiting from the spread. This strategy requires swift action and access to multiple trading platforms.

Successful #arbitrage traders often use automated bots to identify and execute trades quickly. While the profit margins per trade can be small, the cumulative gains can be substantial for those who can consistently exploit market inefficiencies.

Conclusion

Each strategy requires a deep understanding of market dynamics, technical analysis, and risk management. Traders often combine multiple strategies or adjust their approach based on market conditions to optimize their trading outcomes.

This educational article has been brought to you by the leading cryptocurrency exchange https://www.biconomy.com/. We have been operating since 2019 and offer all types of cryptocurrency services to beginners as well as experienced traders, including futures and spot trading, demo trading tool, staking and others.

Always be aware of the risks, monitor your positions carefully, and remember - only you bear full responsibility for both your profits and your losses.

Join us not to miss hot activities like airdrops, AMAs rewards and many more on: https://twitter.com/BiconomyCom