The launch of bitcoin-ETF spot trading in the US has had a significant impact on the digital asset market.

It has provided investors with a new opportunity to capitalize on bitcoin price movements without the complexities associated with direct investment in the cryptocurrency. By purchasing ETF shares, investors can track bitcoin exchange rate movements and don't need secure vaults for the digital asset.

The approval of spot bitcoin ETFs in the US has attracted institutional investors to the market, which in turn has supported bitcoin's rise. However, not everyone in the crypto community has welcomed the development, as some see spot bitcoin-ETFs as a potential threat to the digital asset market.

The race to launch spot bitcoin-ETFs in the US began in 2013 with the #Gemini cryptocurrency exchange team. However, for several years, the US Securities and Exchange Commission (SEC) rejected applications from market participants, citing security concerns.

In the summer of 2023, interest in spot bitcoin ETFs surged when #Blackrock, Wall Street's largest asset management company, applied to launch its own spot bitcoin ETF. Following Blackrock's lead, other market participants also filed similar applications with the SEC.

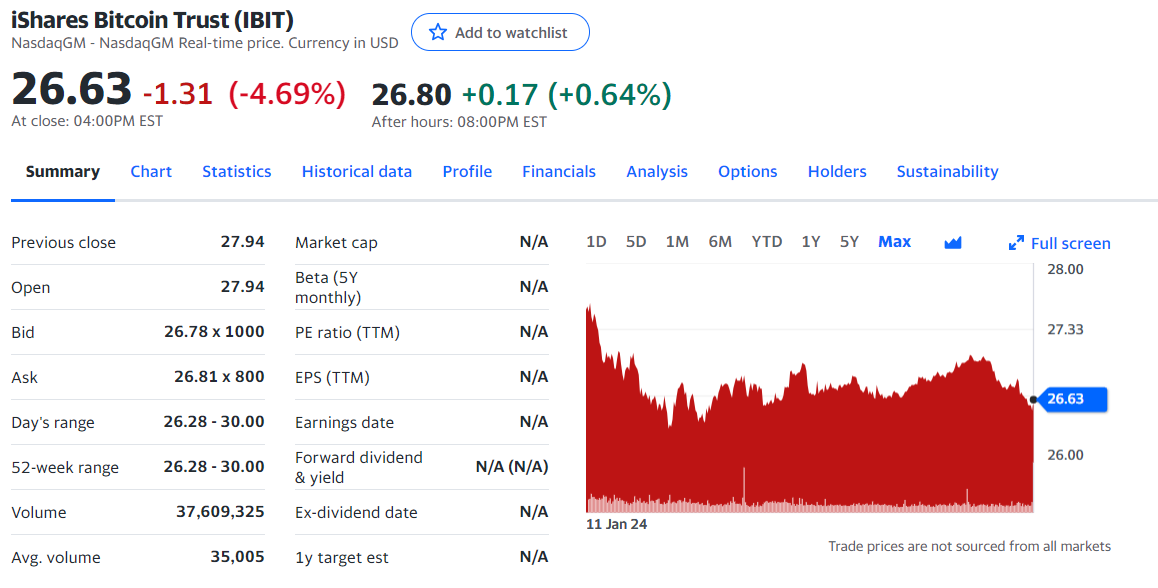

On January 10, 2024, the #SEC approved 11 applications to launch a spot bitcoin-ETF in the US, as predicted by Bloomberg analysts. Trading in the instrument began on January 11.

The market reacted positively to the launch of bitcoin-ETF spot trading in the US. On the first day of trading, the bitcoin price approached the $49,000 mark, followed by a correction.

The trading volume of spot bitcoin-ETFs reached $4.5 billion on the first day, with Blackrock's iShares Bitcoin Trust (#IBIT) leading the way, accounting for 22% of the total trading volume. IBIT closed 4.69% below its opening price.

The launch of spot bitcoin ETFs also led to a reallocation of investors' assets. They started shifting capital from the #bitcoin futures ETFs that were introduced in 2021 to spot ETFs. This reallocation was driven by potential savings on fees associated with spot ETFs.

Overall, the launch of the bitcoin #spot ETF in the US has had a significant impact on the digital asset market. It has attracted institutional investors, supported bitcoin's growth and led to asset reallocation. The positive market reaction indicates the potential for further development and introduction of spot bitcoin-ETFs in the future.