Debtors of the bankrupt cryptocurrency exchange FTX, together with Sullivan & Cromwell lawyers, have made amendments to the exchange's reorganization plan under Chapter 11.

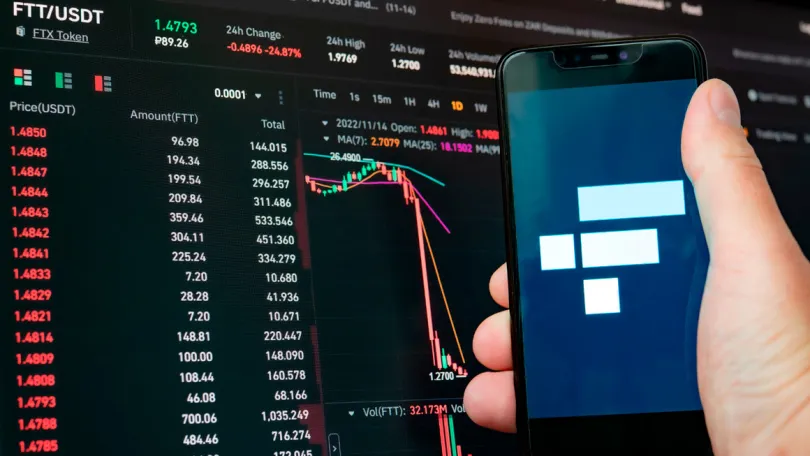

The document states that the value of FTX clients' asset claims needs to be retroactively determined. Debtors seek to assess the value of cryptocurrencies at the time the exchange filed for bankruptcy, which was November 11, 2022. It is worth noting that the value of most cryptocurrencies has recovered after FTX's bankruptcy.

In November 2022, for instance, #Bitcoin was trading near $17,000. At the time of publication, its value stands at $41,200. One of FTX's creditors, Sunil Kawuri, believes that the new reorganization plan contradicts FTX's servicing terms. According to him, ownership rights to #digital assets belong to the clients, not the exchange.

FTX Debtors have filed the reorg. Plan

— Sunil (FTX Creditor Champion) (@sunil_trades) December 16, 2023

Most importantly they have ignored FTX TOS that states Digital Assets are the property of Users and not FTX Trading

The plan says that Digital Assets are valued at Petition Date conversion rates (prices) pic.twitter.com/WTj07nlOP5

According to #court records, from August to October 2023, the bankrupt crypto exchange received a bill totaling over $118 million for legal and advisory services, amounting to $1.3 million per day. The largest bill came from consulting firm Alvarez and Marshall, whose services were valued at $35.8 million over three months.

BTW @lopp this estimates $1.45B of remaining professional fees for a total of $1.8B. The Estate is currently charging $0.5B per year and bankruptcies are not short endeavors.

— Mr. Purple 🛡️ (@MrPurple_DJ) December 17, 2023

To date, here are the fees that have been petitioned in just under 1 year (~$350mm has been paid): https://t.co/fZhMyTE3B1 pic.twitter.com/5p6at5ZbWy

Data provided by user X (formerly Twitter) in a message dated December 17 shows the total amount of legal expenses, which is approximately $350 million.

In late November 2023, FTX received permission to sell trust assets worth around $744 million. The proceeds will be used to repay the debts owed to the creditors of the collapsed exchange. This move was seen as a significant step towards resolving the financial obligations arising from the company's bankruptcy.

It is worth mentioning that in November, #FTX filed a lawsuit against the #Bybit exchange, demanding the return of $953 million.