On the night of March 15, 2024, the price of bitcoin briefly fell to $66,700. Then the cryptocurrency successfully recovered the lost positions.

Bitcoin then maintained a downward trend throughout the day, and its value fell below USD 66,000.

Bitcoin is currently trading above $68,000 and is looking to stabilize at this level. The market situation is characterized by high #volatility.

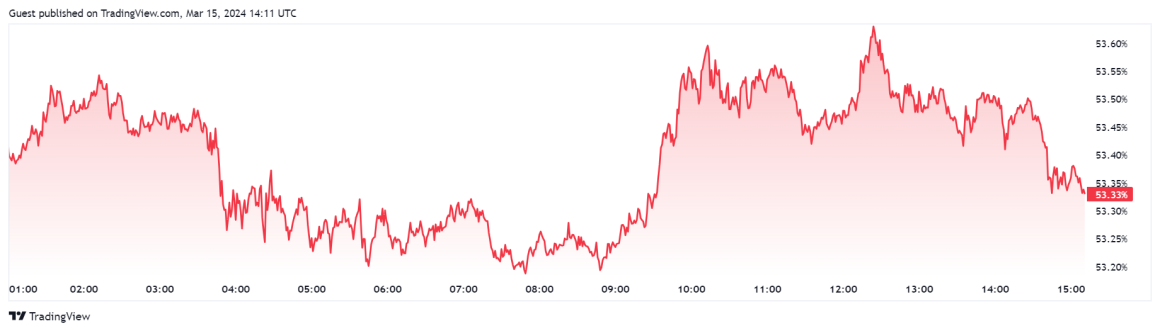

It is worth noting that the bitcoin dominance graph is also experiencing significant fluctuations. This indicator decreased from 53.9% to 53.2%:

In addition, in less than 24 hours, the total clearing of futures contracts exceeded $670 million: according to Coinglass, most of the losses were in long positions.

The fall in the bitcoin rate was also reflected in the rates of other cryptocurrencies. Of the top 10 coins by market capitalization, eight are currently in negative territory.

Despite the downturn, investors seem to be in a positive mood. This sentiment is reflected in the Fear and Greed Index, which has stabilized at 83.

Several analysts have interpreted the decline in major cryptocurrencies as a natural event after a sharp uptrend.

An increase in trading volume in bitcoin fund #Blackrock has caused concern in the market, with Adrian Wang, CEO of Metalpha, suggesting that:

"the decline suggests that the market is adjusting its expectations for bitcoin amid uncertainty around the price around #halving."

However, analysts at QCP Capital expect the drop in bitcoin's value to be short-lived:

"As long as demand for the #ETF bitcoin spot remains strong, this sell-off will not derail the uptrend."

It is worth recalling that on March 13, 2024, the price of bitcoin reached an all-time high. At that time, the cryptocurrency reached a mark of 73,650 US dollars.