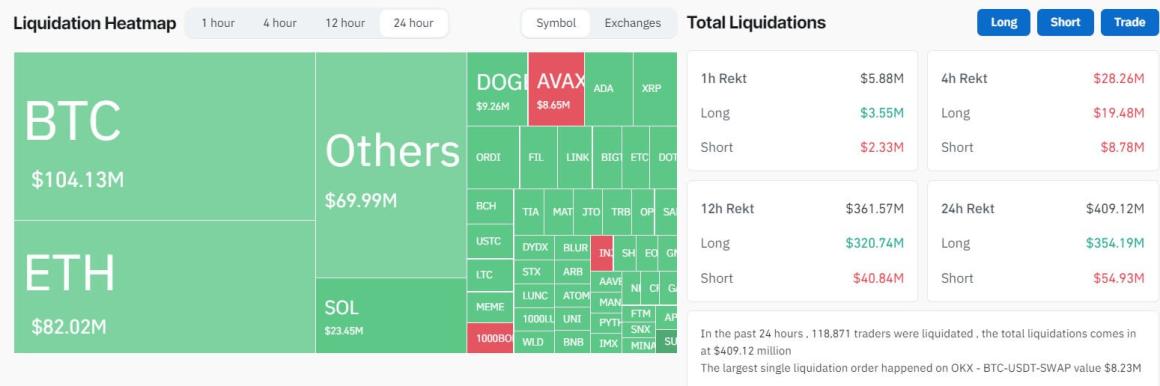

In the past 24 hours, the crypto market experienced a significant downturn, resulting in substantial losses for traders. According to #Coinglass data, over $400 million was lost by nearly 120,000 crypto traders during the opening of Asia trading hours on December 11th.

The majority of these losses, approximately $356 million, were attributed to long positions, indicating a significant loss driven by long speculation. This marks the most extensive single-day loss caused by long positions in the last four months. Short traders also faced losses, totaling $54.79 million.

#Bitcoin traders were particularly affected, accounting for approximately $104 million in total liquidations. Long positions in BTC contributed $90.9 million to this figure, while shorts accounted for $12.12 million. Ethereum investors also faced considerable losses, with around $74.62 million liquidated in long positions alongside $6.52 million from short positions.

Other cryptocurrencies, including Solana, XRP, #Dogecoin, #Avalanche, #Cardano, and #Litecoin, also saw notable losses for traders holding long positions during this period.

Among exchanges, OKX and Binance witnessed the most significant losses, with liquidations exceeding $171 million and $128 million, respectively. Notably, the most substantial individual loss recorded was an $8.2 million long bet on Bitcoin's price on the #OKX exchange.

The impact of these liquidations extended beyond Bitcoin and Ethereum, as the market as a whole experienced a decline. Bitcoin's price tumbled around 5% to a low of $41,649 before recovering to its current value of $42,155. This decline in BTC's price triggered price declines in other major cryptocurrencies, such as #Ethereum, #Solana, XRP, #BNB, and Cardano, resulting in some of their most considerable losses in recent weeks.

The global crypto market capitalization also fell by around 4% to $1.57 trillion.

It is important to note that this recent drop comes after a three-month surge fueled by optimism about the potential approval of a Bitcoin Exchange-Traded Fund (#ETF) in the United States. While the approval has not materialized yet, ongoing communications between the U.S. Securities and Exchange Commission (#SEC) and the applicants are seen as a positive sign. This suggests that the regulator might finally give the green light to these investment products.

In conclusion, the recent crypto market liquidations have had a significant impact on traders, resulting in substantial losses across various cryptocurrencies. Bitcoin and Ethereum were particularly affected, with long positions in these assets contributing to the majority of the losses. The decline in BTC's price also triggered price declines in other major cryptocurrencies. Traders holding long positions in Solana, #XRP, Dogecoin, Avalanche, Cardano, and Litecoin also experienced notable losses. The overall market capitalization of the crypto market also saw a decline. However, there is optimism regarding the potential approval of a Bitcoin ETF in the United States, which could have a positive impact on the market in the future.