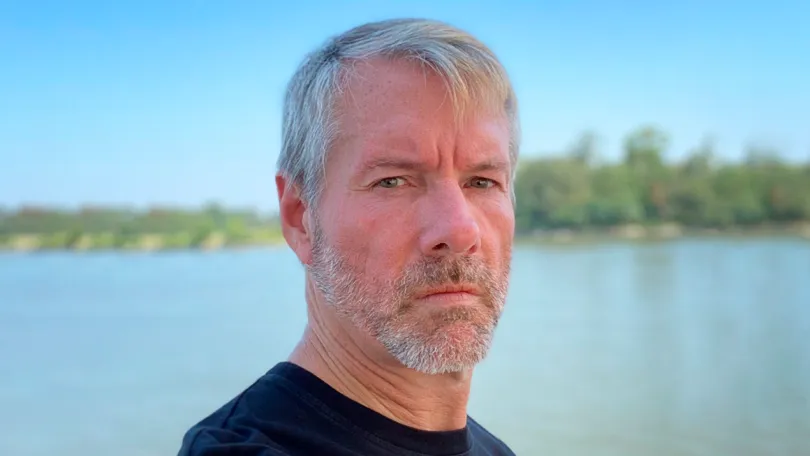

Michael Saylor, one of the founders of technology giant #MicroStrategy, boldly stated that bitcoin will "absorb" gold and become a more valuable asset than traditional precious metals.

In his opinion, the main cryptocurrency embodies all the advantages of gold, but is free from its limitations. Mr. Saylor emphasized the slow mobility of gold compared to bitcoin, which can be instantly transferred to new owners.

In addition, Mr. Saylor expects bitcoin to reduce the market share of other high-risk investment instruments. He singled out the SPDR S&P 500 ETF as a likely victim of this shift.

Observing market dynamics, Mr. Saylor noted that #BlackRock has purchased physical shares of the #Bitcoin ETF for its Global Allocation Fund.

On March 11, 2024, bitcoin surpassed silver in market capitalization, reaching a major milestone of $1.4 trillion and becoming the eighth largest asset in the world.

JP Morgan analysts recognize the rapid progress of digital assets, although they believe that bitcoin will not equal gold in investors' portfolios for some time yet.

Notably, #bitcoin has already surpassed #gold in key indicators. In particular, in terms of the volume of assets in investors' portfolios (adjusted for volatility).