In the volatile world of cryptocurrencies, a bull market represents a period of exhilarating highs and seemingly limitless potential.

During these times, the market sentiment is overwhelmingly positive, with prices soaring and investors eager to capitalize on the upward trend.

However, navigating a bull market requires strategic planning and disciplined decision-making to maximize profits while minimizing risks. In this comprehensive guide, we will explore the essential strategies and tactics to thrive in the world of cryptocurrencies during a bull market.

Conduct Thorough Research

Before diving headfirst into the frenzy of a bull market, it is crucial to conduct thorough research. Familiarize yourself with the fundamentals of #blockchain technology, understand the underlying principles of various cryptocurrencies, and stay updated on market trends and news. By equipping yourself with knowledge, you can make informed investment decisions and identify lucrative opportunities amidst the chaos.

Diversify Your Portfolio

Diversification is the cornerstone of a resilient investment strategy, especially in a volatile market like cryptocurrencies. Instead of putting all your eggs in one basket, spread your investments across multiple cryptocurrencies with different use cases, market capitalizations, and risk profiles. This diversification not only mitigates risk but also allows you to capitalize on the growth potential of various projects.

Set Clear Investment Goals

Define your investment goals and objectives before entering the #bull market. Whether you aim for short-term gains or long-term wealth accumulation, having clear goals will guide your decision-making process and prevent impulsive actions driven by market euphoria. Establish realistic profit targets and risk tolerance levels to maintain discipline and avoid succumbing to #FOMO (fear of missing out).

Embrace Dollar-Cost Averaging (DCA)

Dollar-cost averaging is a prudent investment strategy that involves regularly investing a fixed amount of money into cryptocurrencies regardless of market fluctuations. By spreading your purchases over time, you can mitigate the impact of volatility and benefit from the market's long-term upward trajectory. #DCA allows you to accumulate assets at various price points, reducing the risk of buying at the peak of a bull market.

Monitor Market Trends and Sentiment

Stay vigilant and monitor market trends, sentiment indicators, and technical analysis to gauge the overall health of the cryptocurrency market. Pay attention to factors such as trading volume, price movements, social media discussions, and institutional involvement. By staying informed, you can anticipate market shifts, identify emerging opportunities, and adjust your strategy accordingly.

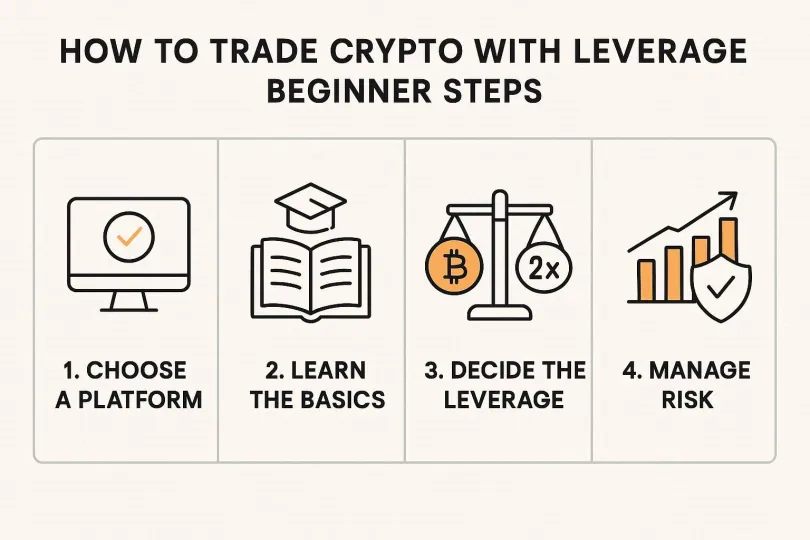

Practice Risk Management

Risk management is paramount in the world of cryptocurrencies, especially during a bull market characterized by heightened volatility and irrational exuberance. Allocate only a portion of your portfolio to high-risk assets, diversify across different asset classes, and set stop-loss orders to limit potential losses. Additionally, avoid overleveraging and never invest more than you can afford to lose.

Take Profits Strategically

While it can be tempting to hold onto your investments indefinitely during a bull market, it is essential to take profits strategically. Set predetermined profit targets and rebalance your portfolio periodically to lock in gains and mitigate downside risk. Consider scaling out of positions gradually as prices rise, and reinvest profits into undervalued assets or stablecoins to preserve capital.

Stay Emotionally Resilient

Maintaining emotional resilience is crucial amidst the euphoria and volatility of a bull market. Avoid making impulsive decisions driven by greed or fear, and stick to your predetermined investment strategy. Remember that market fluctuations are inevitable, and short-term price movements should encourage you to achieve your long-term goals. Keep a rational mindset, stay disciplined, and focus on the fundamentals of your investments.

Navigating the world of cryptocurrencies during a bull market requires a combination of strategic planning, disciplined execution, and emotional resilience. By conducting thorough research, diversifying your portfolio, setting clear investment goals, embracing dollar-cost averaging, monitoring market trends, practicing risk management, taking profits strategically, and staying emotionally resilient, you can maximize profits and navigate the exhilarating highs of a bull market with confidence and composure.

This educational article has been brought to you by the leading cryptocurrency exchange https://www.biconomy.com/ - we have been operating since 2019 and offer all types of cryptocurrency services to beginners as well as experienced traders. Always be aware of the risks, monitor your positions carefully, and remember - only you bear full responsibility for both your profits and your losses.

Join us https://twitter.com/BiconomyCom