The US Securities and Exchange Commission (SEC) has definitely stepped up its oversight of the cryptocurrency industry in 2023, according to analysts at consulting firm Cornerstone Research.

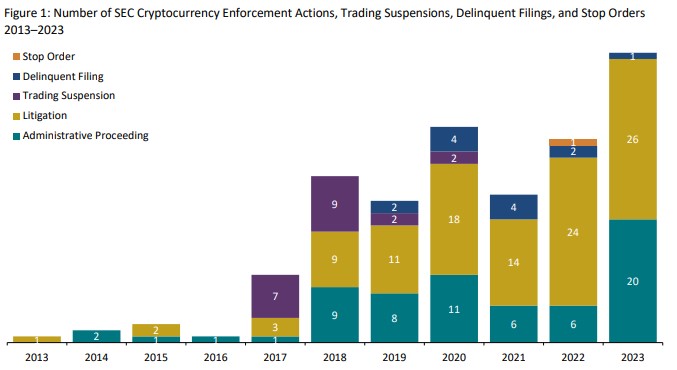

According to their data, the regulator has taken 46 enforcement actions related to cryptocurrencies, a 53% increase from the previous year. Since 2013, the SEC has initiated a total of 173 enforcement actions against cryptocurrency organizations, and 2023 was a new record.

The report highlights that the 46 enforcement proceedings against cryptocurrency companies initiated by the SEC in 2023 represent the highest number of such proceedings in a single year.

The Cornerstone Research analysis also shows that the SEC imposed $2.89 billion in fines against cryptocurrency market participants between 2013 and 2023, with $281 million of that amount being imposed in 2023 alone.

Most of these enforcement proceedings involved allegations of fraud and trading in unregistered securities. Notably, the number of administrative cases tripled, indicating the SEC's increased focus on industry compliance.

Additionally, 37% of SEC actions targeted initial coin offerings (#ICO) in the cryptocurrency market. As a result, the agency penalized 124 organizations, of which 46% were companies and 54% were individuals.

It's worth noting that in November, the SEC released a report on its activities, which revealed that the agency filed 784 lawsuits in 2023. Notable cases include major crypto fraud allegations against #Terraform Labs, Richard Hurt, three companies under his control, and FTX CEO #Sam Bankman-Fried.

In addition, #SEC initiated its first lawsuits against issuers of non-functioning tokens (#NFT). Impact Theory LLC and Stoner Cats 2 LLC were accused of conducting illegal unregistered offerings of cryptoasset securities in the form of NFTs.