In 2023, the #hashrate of the bitcoin network has grown significantly - by 90%. CoinShares experts in their report assessed the future prospects of the industry by analyzing the profitability and sustainability of mining.

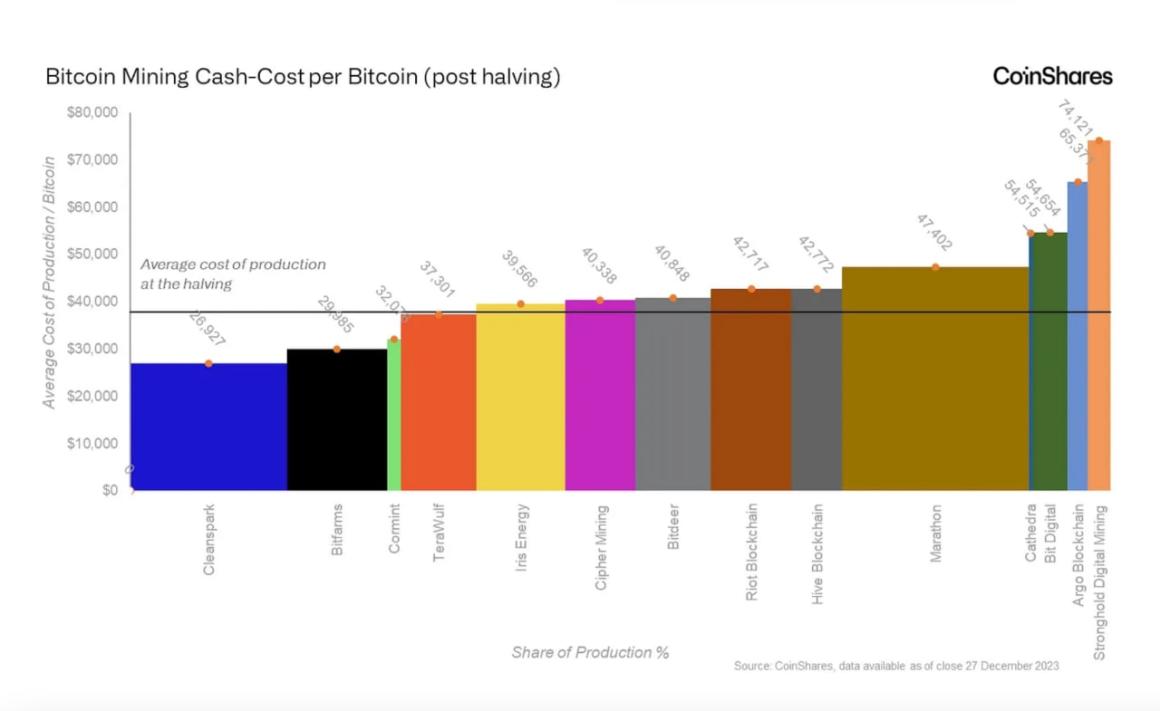

CoinShares predicts that the average cost of bitcoin mining will rise to $37,856 after the halving expected in April 2024. The reward for mining each block will halve to 3.125 BTC, and the overall speed will decrease as part of deflationary measures, according to experts.

Want to understand the impact of the halving on Bitcoin Miners revenues and how bitcoin mining can reduce global CO2 emissions? Please do read our 2024 mining reporthttps://t.co/0gJBTMB4yq

— James Butterfill (@jbutterfill) January 12, 2024

According to the report, the average energy consumption of the grid is currently 34 W/T, but this could fall to 10 W/T by mid-2026.

"To reach break-even, companies will have to cut commercial and administrative costs. It is likely that they will have to liquidate some of their cryptocurrency assets "experts emphasized the importance of reducing costs to avoid operational losses.

The study emphasizes that bitcoin miners finance their capital expenditures with their own or borrowed funds. If the bitcoin price falls, these companies may face additional risks due to high #interest rates.

Analysts expect bitcoin to trade at around $40,000 after halving. If the price falls below this threshold, mining will become unprofitable for many companies. Only Bitfarms, Iris, CleanSpark, TeraWulf and Cormint are expected to operate at a profit, the report said.

According to CoinShares, about 53% of the electricity used for mining is generated from renewable sources. However, in 2023, electricity demand from miners has surged by 44% to 115 TWh per year.

As experts point out, most bitcoin miners are actively seeking to improve their efficiency. They are investing in new #equipment that provides reduced power consumption and increased productivity.

It is worth noting that the #CleanSpark mining company has signed an agreement to purchase 160,000 #Bitmain S21 devices by the end of 2024. In addition, #Phoenix Group and #Cipher have expressed their intention to purchase additional batches of mining equipment.