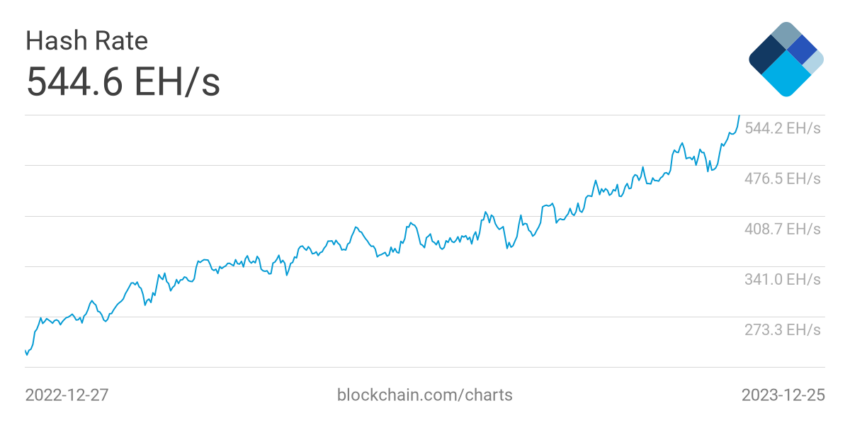

On December 26, the computing power used by the Bitcoin (BTC) network reached an all-time high. However, the profitability of mining in the blockchain of the leading cryptocurrency began to decline. BTC's hashrate is currently at 544 EH/s. Just two days before, on December 24, it peaked at 528 EH/s.

Hashrate represents the amount of computing power used per second. An increase in this figure means increased activity of miners. Miners are expanding their operations and using more power to maximize their profits.

Throughout the year, the hashrate of BTC was continuously growing and eventually showed +130% by the beginning of the year. In January, this figure barely exceeded 250 EH/s.

At the same time, there has been an increase in the value of bitcoin. Over the past 12 months, the bitcoin price has grown by an impressive 153.3%. At the time of writing, the asset is trading at $42,986.

The record-breaking hashrate has coincided with #mining difficulty. During the last recalculation on December 23, the difficulty reached 72.01 T. Bitcoin's mining difficulty is expected to rise to 73.91 T in ten days, by January 5, 2024.

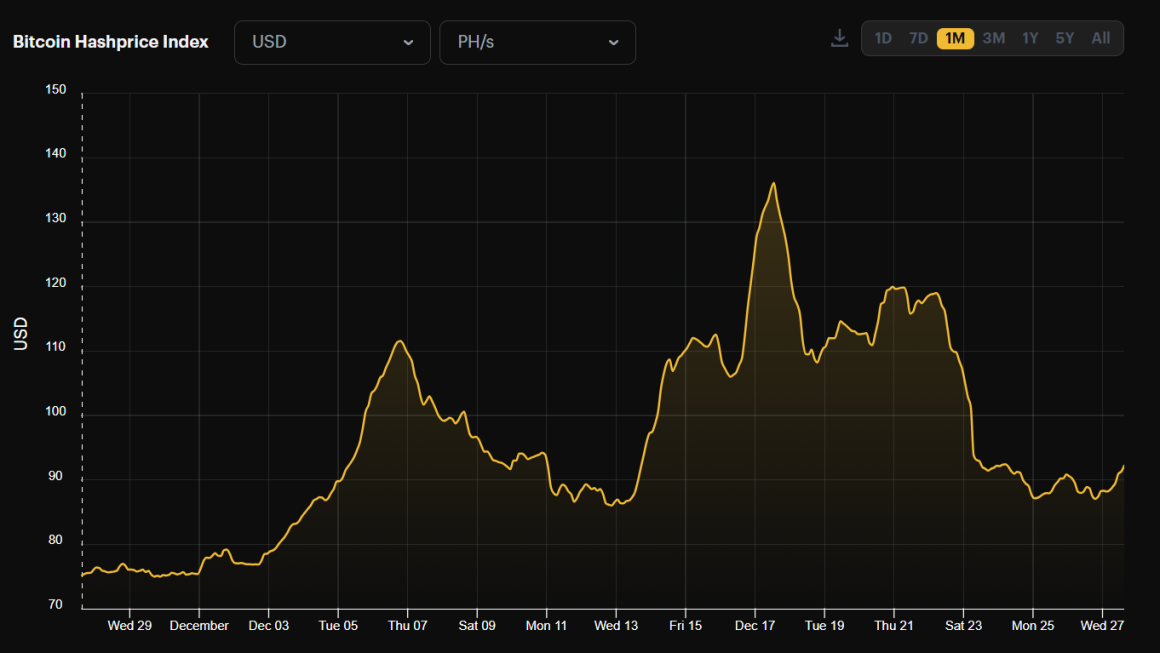

Decreasing profitability of mining

According to Will Clemente, co-founder of analytics platform Reflexivity Research, the high hash rate may be beneficial for theoretical price models. For miners, however, it creates problems. They have to put in even more effort to mine the next block.

Over the past month, #BTC mining yields have fallen by 34%, dropping from a high of $0.136/TH/s/day to $0.09/TH/s/day. Analyst Glassnode attributes this decline to rising transaction fees.

Last week, transaction fees on the bitcoin blockchain jumped to $40, further reducing the profitability of mining.

At this point, the Bitcoin network #hashrate has reached new heights, indicating an increase in miner activity. However, this sharp rise in hashrate has led to a decrease in the profitability of #mining, primarily due to the increase in transaction fees. Going forward, in anticipation of the #halving, experts predict the rally to continue.