The year 2022 was a disastrous year for cryptocurrencies. During the year, the market faced a number of negative events. Fortunately, bitcoin stood its ground once again. Buyers showed up at the $15,500 level. Some were waiting for the bitcoin price to fall below $10,000, but never waited and missed the opportunity to go under.

Since hitting a market low, BTC is up about 185%. On a monthly basis, the price has been on a downward trajectory since May 2022, closing below $33,000. In March, BTC signaled a positive signal on the monthly chart, closing above $25,000. Since then, the price has reversed its momentum. The close marked the end of the previous trend, which was characterized by descending lows and highs. Subsequently, the price established a clear uptrend, closing above $32,000. Bitcoin on the monthly timeframe is now showing bullish sentiment. The RSI index has also broken the bearish trend line and is making upward lows and highs. Buyers currently have the advantage in terms of monthly momentum. As a result, the RSI still has room to rise before entering the overbought zone (above 70). This indicates that price is not overly bullish on a monthly basis. Based on this information, it looks like a new cycle has begun.

Bitcoin to USDT rate (1M)

Bitcoin to USDT rate (1M)During the previous cycle, a return to a bullish bias (EMA 9/EMA 18) served as a great buying opportunity in the market. In the event of a downturn, buyers could step on these moving averages above $30,000. Historically, it took BTC over 700 days to reach a new all-time high after hitting a market low. If this pattern repeats, it could lead to a new all-time high in October 2024. The catalysts for bitcoin price growth in 2024 could be a halving event and the introduction of spot bitcoin ETF funds.

What's in store for Bitcoin after $50,000?

Having analyzed the monthly data, let's shift our attention to the weekly timeframe. On the weekly timeframe, the price is showing bullish momentum and is trading above the bullish trend line.

Despite the recent drop to the $41,500 support level, buyers have responded. As long as the support holds, a move back to the next resistance level at $47,000 is possible. On the other hand, a break of support could push the price back to the next support level at $38,000. The RSI index is bullish and is making upward highs and lows. Therefore, buyers currently have the advantage.

BTC has overcome the first resistance level (0.382 Fibonacci retracement) at $36,000. The next target is in the shorting congestion zone (0.618-0.786 Fibonacci retracement), which lies between $48,500 and $57,500. It is possible that bitcoin will return to the $50,000 level, but caution should be exercised in such a scenario. The shorts reset zone is an area where sellers usually regain control.

Bitcoin's dominance is bullish: BTC is attracting capital

The bitcoin dominance chart shows where capital is primarily flowing to - bitcoin or altcoins. For more than a year now, capital has been flowing into BTC.

The price is showing bullish momentum and capital continues to flow into BTC. This trend could continue if the recent low of 51.7% holds. In that case, the price could rise to the next resistance level at 58%. However, if it falls below 51.7%, #altcoins could benefit from capital overflow. Will 2024 continue to follow the same trend?

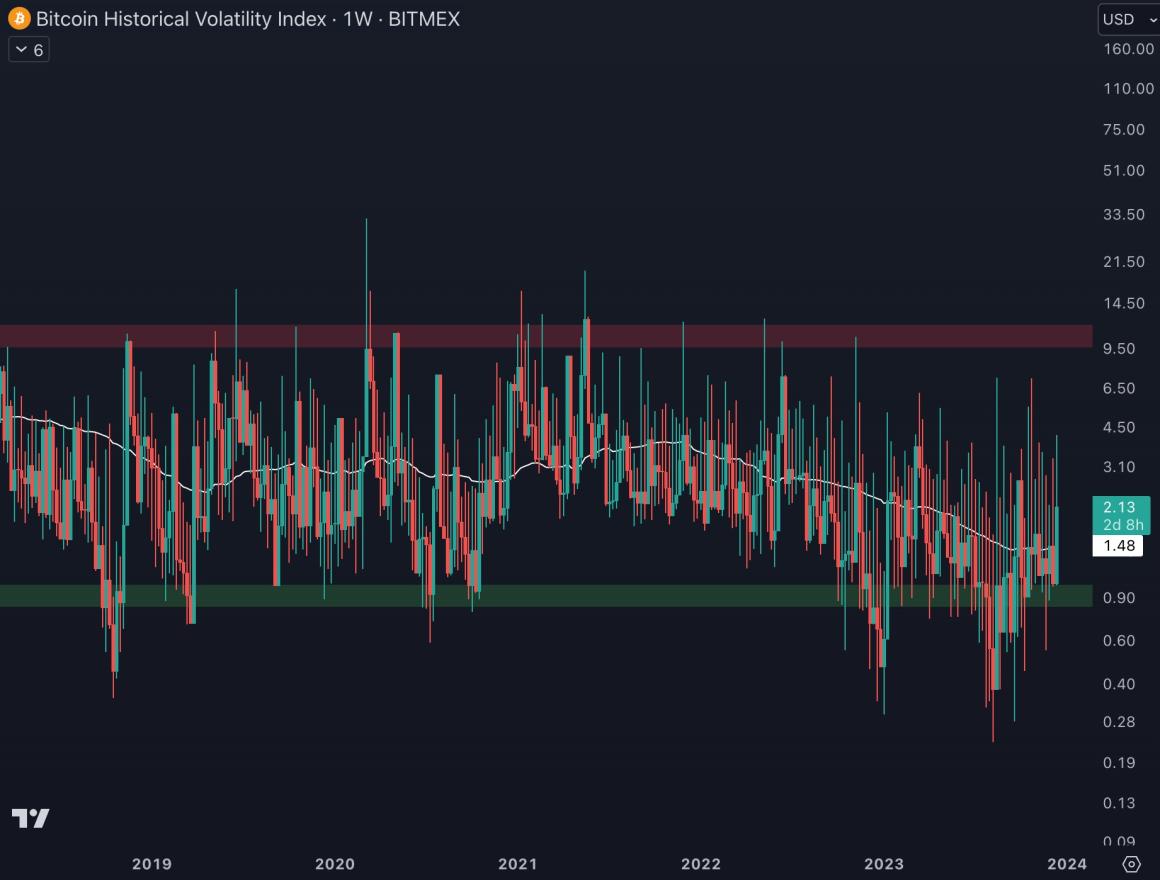

Bitcoin's declining volatility: positive news for cryptocurrency adoption?

Bitcoin, which is often criticized for the environmental impact of the mining process, is also known for its volatility. Bitcoin's capitalization is much lower than gold, which contributes to its volatility. However, this seems to be decreasing.

As you can see, the weekly 50-period moving average has been consistently declining since 2019. Since the end of 2021, the decline has even accelerated. Given bitcoin's growing capitalization, it's logical to see a decrease in #volatility over time. This is a positive for cryptocurrency adoption. However, volatility could rise again in 2024 if a bull market occurs.

Despite the rise, the number of Google searches on Bitcoin remains low

Speculation surrounding bitcoin spot ETFs has likely contributed to the main cryptocurrency's growth in 2023. However, the level of interest is still far from what was seen during the previous cycle.

2023 has been a bullish year for #Bitcoin and cryptocurrencies. BTC is currently showing bullish momentum on a monthly and weekly basis. Theoretically, BTC could continue its ascent and reach the $50,000 mark again. However, caution should be exercised as this level could attract sellers. For now, capital is pouring into bitcoin and this trend could continue until 2024. The #Bitcoin Spot ETF and the #halving event are catalysts that could drive capital inflows to the crypto market. Despite the revival in 2023, the number of bitcoin-related Google searches remains relatively low.

After a year of rising from the ashes, we should be ready for new opportunities in 2024!