The bitcoin price is currently experiencing a downturn and this can be attributed to the actions of miners.

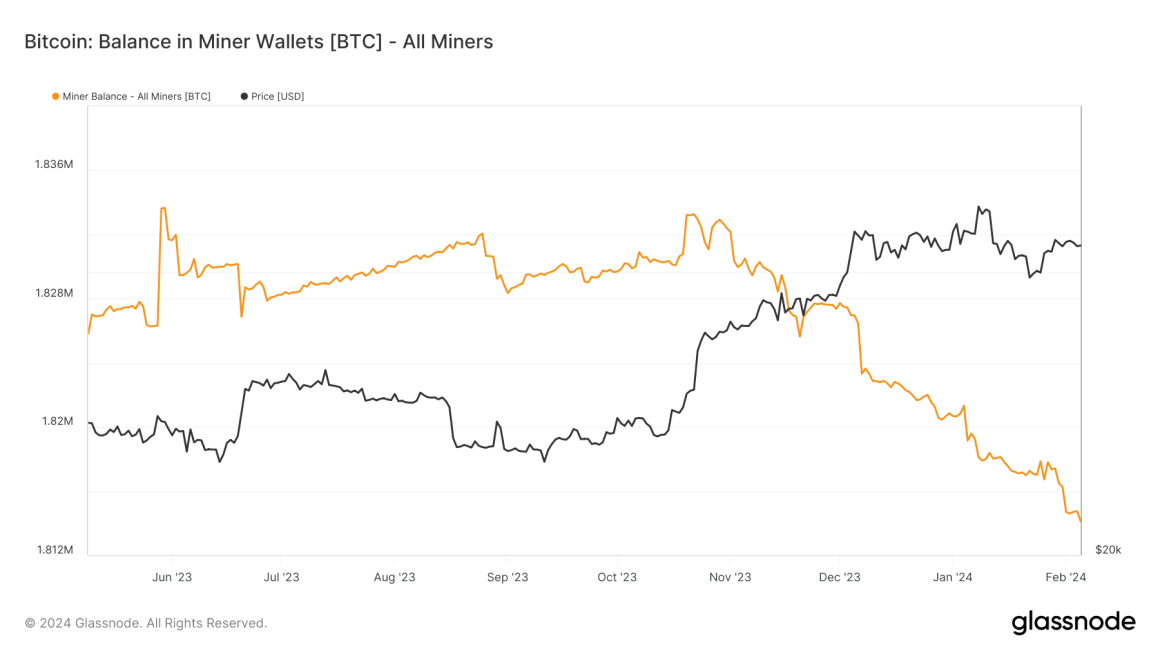

Miners are selling their assets to accumulate capital to modernise their infrastructure, which has a significant impact on the market. This information is supported by Glassnode's analytical data, which shows a steady decline in bitcoin holdings by miners since the beginning of the year.

The recent drop in the bitcoin price, especially after the approval of the spot #ETF, is largely due to miners selling off their holdings. This sell-off not only allows miners to fund #infrastructure upgrades, but also highlights their significant impact on market #liquidity and pricing.

According to experts, last week saw the largest outflow of funds from miners' wallets ever and this trend is expected to continue. This further emphasises the influence of miners on the market and their role in shaping the price of bitcoin.

Additionally, a recent CoinShares report suggests that the cost of mining the cryptocurrency will increase significantly after #halving. If the price of bitcoin falls below the $40,000 mark, it may become unprofitable for small miners to continue their operations.

Currently, #bitcoin is trading at $43,200. Although there is a slight drawdown on the weekly chart, the impact of miners on the market remains an important factor to consider.