Discover how blockchain forensics helps combat crypto-related crimes and whether the authorities can find out who owns a crypto address.

Criminal activities involving cryptocurrencies are common and include a wide range of illegal actions like ransomware attacks and breaches that target cryptocurrency #exchanges.

Most times, the stolen digital assets are never recovered due to the various techniques criminals use to complicate crypto tracking. However, blockchain forensics has somewhat made it possible for authorities to track illegal crypto transactions and potentially recover the associated assets. In this guide, you will learn how they do it.

What is blockchain forensics?

Blockchain forensics uses scientific techniques to track and interpret the flow of #crypto assets on the blockchain. While transactions on public blockchain networks are visible to everyone, blockchain forensic experts use specialized tools and methods to decipher, examine, and interpret blockchain data.

Personal identities aren’t associated with wallet addresses, making it difficult for organizations to pin real people to crypto-related financial crimes. However, blockchain forensic techniques have improved over the years, and organizations have been able to recover some illegally acquired #digital assets.

To illustrate the effectiveness of blockchain forensics, let’s take the case of the Colonial Pipeline, a prominent U.S. oil pipeline company that fell victim to a ransomware attack orchestrated by a group known as DarkSide in 2021. The perpetrators demanded a ransom payment of 75 bitcoins (BTC).

The company paid the ransom hoping the hackers would end the attack, which had crippled operations and led to an emergency declaration by President Joe Biden. However, in a remarkable display of investigative prowess, a blockchain security firm, Mandiant, in collaboration with the FBI, employed blockchain forensics and undisclosed methodologies to trace the ransom payments. They managed to recover a substantial portion of the funds, reclaiming 64 out of the 75 BTC that had been extorted.

How does blockchain forensics work?

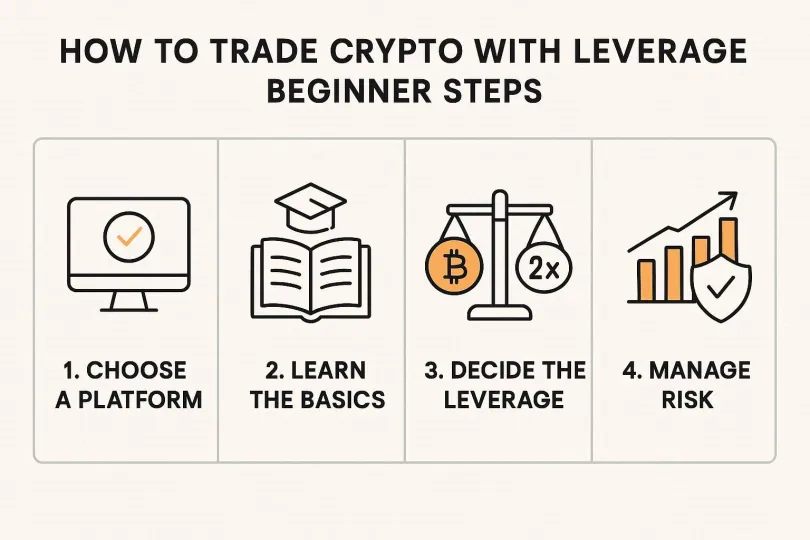

While blockchain forensic specialists don’t all work in the same way, there are specific steps that they generally follow:

- Data collection: The first crucial step in blockchain forensics involves collecting relevant data. Investigators can gather transaction data from various sources, such as blockchain explorers, crypto exchanges, and digital wallets associated with a case. This data can include transaction hashes, addresses, timestamps, and transaction amounts.

- Data analysis: Once the data is collected, the next step is to analyze it for potential patterns and clues. Blockchain forensics experts utilize specialized software tools to examine transactional data and identify suspicious or noteworthy activities. They look for irregularities, such as large transactions, frequent transfers, or connections to known illicit entities.

- Address clustering: This is a crucial technique used in blockchain forensics to group related addresses and transactions. Investigators identify addresses controlled by the same entity by analyzing patterns, such as shared inputs or outputs. By clustering addresses, they can gain insights into the flow of funds and trace the movement of illicit transactions across the blockchain.

- Linking identities: Blockchain forensics aims to connect blockchain addresses to real-world identities whenever possible. It can be challenging, as blockchain transactions are pseudonymous, with addresses typically represented by alphanumeric strings. However, investigators employ various methods, including analyzing transaction metadata, correlating addresses with known entities, and leveraging external data sources, such as exchange’s #KYC (Know Your Customer) information, IP addresses, or social media profiles. These connections can help reveal the individuals or entities behind the transactions.

- Transaction visualization: To understand complex transaction flows, investigators often utilize transaction visualization tools. These tools generate visual representations of blockchain transactions, highlighting the movement of funds between addresses. By examining the visualizations, investigators can identify patterns, track the flow of funds, and uncover potential money laundering or illicit activities. Some popular blockchain analytics tools include #Chainalysis, Elliptic, and CipherTrace.

- Chain analysis: Blockchain forensics also involves chain analysis, which focuses on tracing transactions backward through the blockchain. Investigators analyze transactions in reverse chronological order, following the path of funds to their original source. This approach helps identify the initial entry point for illicit funds, allowing authorities to uncover money laundering schemes or fraudulent activities.

- Collaboration and data sharing: Blockchain forensics often involves collaboration between law enforcement agencies, regulatory bodies, and blockchain analytics firms. Sharing information, expertise, and tools is crucial in developing effective strategies to combat illicit activities on the blockchain. It enables the pooling of resources and knowledge, ultimately enhancing the accuracy and efficiency of investigations.

- Reporting and legal proceedings: The final step in the blockchain forensics process is the preparation of detailed reports. Investigators compile their findings, including evidence, transaction histories, address clustering, and identified individuals or entities. These reports serve as crucial evidence for legal proceedings, providing a comprehensive overview of the illicit activities detected within the blockchain ecosystem.

How do blockchain forensics companies track crypto transactions?

Blockchain forensics companies employ various techniques to track and analyze crypto transactions within the blockchain network. Despite the common misconception that bitcoin transactions are completely anonymous, they can be traced back to their source.

However, since transaction data does not include personal identifying information, such as names and addresses, it raises the question of how these companies are able to effectively follow the money.

To tackle this challenge, blockchain forensic investigators utilize a combination of methods and tools.

Analysis of attribution data

The attribution data includes IP addresses and cluster wallet addresses. By tracing the digital footprints left behind by users, investigators can establish connections and identify patterns that lead them to the individuals or entities involved in the transactions.

KYC information

KYC information plays a crucial role in tracking crypto transactions. Many reputable crypto exchanges and platforms require users to undergo a KYC process, which involves verifying their identity. Blockchain forensic companies can access this information, allowing them to link specific wallet addresses to real-world identities.

Common spend

The common spend method involves identifying crypto addresses controlled by the same person or entity. Investigators analyze instances where multiple wallet addresses with small amounts of cryptocurrency are used to fund a larger transaction. By using specialized intelligence tools, they can trace the flow of funds from the initial address to a cluster of addresses likely owned by the same entity.

Address reuse

Blockchain forensic investigators look out for addresses that criminals have reused in multiple transactions. When an address appears in various input and output transactions, investigators can infer that it belongs to the same individual or entity involved in illicit activities.

Limitations due to tracking the blockchain

Like any other field, blockchain forensics has its limitations. Understanding these limitations is crucial to comprehend the challenges investigators face in uncovering illicit activities. Let’s look at some of them:

- Pseudonymous nature of blockchain transactions: While transactions are recorded on the public ledger, they are typically associated with alphanumeric addresses rather than real-world identities. It makes it difficult to directly link transactions to specific individuals or entities without additional corroborating evidence. Investigators must rely on external data sources, such as exchange KYC information or IP addresses, to establish these connections.

- Limited access to off-chain data: Blockchain forensics primarily analyses on-chain data, including transactional information recorded on the blockchain. However, important contextual information may reside off-chain, such as metadata associated with transactions or communication between parties involved. Accessing this off-chain data can be challenging and may require cooperation from third parties or legal authorities, which can impede the investigative process.

- Privacy-enhancing technologies: Privacy-enhancing technologies, such as mixers, tumblers, and privacy coins, pose significant challenges to blockchain forensics. These technologies aim to obfuscate the origin and destination of funds, making it difficult for investigators to trace transactions accurately. By leveraging techniques like coin mixing and encryption, individuals can significantly enhance their privacy on the blockchain, further complicating the forensic analysis process.

- Blockchain scalability: A blockchain’s ability to handle a high volume of transactions remains a limitation in blockchain forensics. As the number of transactions continues to grow, the size of the blockchain increases, making data collection and analysis more time-consuming and resource-intensive. Scaling issues can hinder the efficiency of forensic investigations, potentially leading to delays in uncovering illicit activities.

- Global jurisdictional challenges: Blockchain transactions can span across multiple countries, each with its own legal frameworks and #regulatory requirements. Coordinating investigations across borders and obtaining cooperation from international authorities can be complex and time-consuming, impacting the effectiveness of blockchain forensics efforts.

- Blockchain anonymization techniques: Some advanced users employ sophisticated anonymization techniques to conceal their activities on the blockchain further. These techniques include utilizing multiple addresses, layering transactions, and employing privacy-centric cryptocurrencies. Such tactics make it increasingly challenging for investigators to establish meaningful connections between transactions and trace illicit funds.

How can you protect your privacy from authorities?

Many governments, including the #US, #Japan, #India, #Russia, and #China, have been accused of tracking crypto transactions. For instance, the US reportedly used technology that extracted internet data from fiber optic cables providing the IP addresses of people performing crypto transactions.

#Coinbasereportedly sold a crypto tracking software tool to the Immigrations and Customs Enforcement (ICE) body in the US, allowing it to trace several digital assets and identify crypto users.

The company denied the allegations:

While blockchain forensics has been helpful in tracing and recovering stolen cryptocurrency, crypto users who are not involved in illegal activities and want to shield their transactions from unnecessary scrutiny still have concerns about protecting their privacy.

While blockchain transactions are inherently traceable, there are measures one can take to enhance privacy and reduce the likelihood of authorities snooping on their crypto activities. Here are some key steps to consider:

- Use privacy-focused cryptocurrencies: Certain cryptocurrencies, such as Monero (#XMR) and Zcash (#ZEC), are designed with privacy as a core feature. These privacy-focused coins employ advanced cryptographic techniques that obscure transaction details, making it significantly harder for external parties to track and trace the flow of funds.

- Utilize mixing or tumbling services: Mixing or tumbling services offer a method to enhance privacy by obfuscating the connection between the sender and receiver of funds. These services shuffle transactions and mix them with others, making it challenging to trace the origin and destination of the funds. However, it's important to note that using mixing services may attract suspicion, as they have been associated with money laundering in some cases.

- Employ anonymous wallets: Anonymous wallets, also known as non-custodial wallets, allow users to retain full control over their private keys and do not require personal identification. By utilizing anonymous wallets, individuals can avoid associating their real-world identities with their crypto transactions.

- Use VPNs and Tor: Virtual Private Networks (VPNs) and Tor (The Onion Router) can add an extra layer of anonymity by encrypting internet traffic and masking IP addresses. VPNs reroute internet connections through different servers, while Tor routes traffic through a network of volunteer-operated servers, making it difficult for authorities to trace crypto transactions back to a specific individual.

- Practice address reuse prevention: Reusing wallet addresses in multiple transactions can diminish privacy. To enhance privacy, it is advisable to generate new addresses for each transaction, reducing the chances of tying multiple transactions to a single identity.

- Maintain OpSec practices: Operational Security (OpSec) practices play a crucial role in safeguarding privacy. This includes being cautious about sharing personal information online, using strong and unique passwords, enabling two-factor authentication (2FA), and regularly updating software and wallets to protect against potential vulnerabilities.

- Educate yourself: Stay informed about the latest privacy-enhancing tools and techniques. Follow reputable sources, participate in online forums, and engage with the crypto community to gather insights and learn from others' experiences.

While these measures can enhance privacy, it's essential to recognize that they may not provide absolute anonymity. Determined adversaries with sufficient resources and expertise can potentially uncover traces of crypto transactions. It is important to consider the legal and ethical implications of one's actions and to comply with relevant regulations and laws.

FAQs

Can the government take my crypto?

No, as long as you hold the private keys. On the other hand, crypto assets on centralized crypto exchanges may be subject to government control.

How does the FBI seize bitcoin?

By using blockchain forensics tools to tie wallet addresses to real-world exchanges or IP addresses, authorities can determine the identity of a perpetrator. If the assets are on an exchange, they can subpoena the platform to reveal the identity of a user and prevent withdrawals.

Can bitcoin be traced back to me?

It’s challenging, but in many cases, the answer is yes. Blockchain forensics firms are doing an increasingly good job tracking crypto transactions and linking them to the individuals behind them. They can analyze transaction metadata and use external data sources, like the exchange’s KYC information, IP addresses, or social media profiles.

How do you recover cryptocurrencies acquired through scams?

You can report the matter to authorities and hire a blockchain forensics company to follow the money. There’s no guarantee, however, that you can recover all or any of the stolen crypto assets.

How does blockchain analytics work?

Blockchain analytics is the process of examining and interpreting data within a blockchain network to gain valuable insights. It involves analyzing the transaction history, addresses, and other metadata associated with blockchain transactions. It employs specialized tools and techniques to trace the flow of funds, identify patterns, and establish connections between different entities or addresses.Analytics platforms can provide valuable information such as transaction volumes, wallet balances, and network activity. This information can be used by businesses, researchers, and regulatory authorities to monitor compliance, track illicit activities, and gain a better understanding of the overall blockchain ecosystem.

What is crypto tracing?

Crypto tracing is the process of tracking and investigating cryptocurrency transactions. It works by following the flow of funds from one wallet address to another. Each transaction leaves a digital trail on the blockchain, allowing investigators to examine the movement of cryptocurrencies and identify the parties involved. Through specialized tools and techniques, investigators can trace the origin and destination of funds, establish connections between different addresses, and gain insights into the behavior and patterns of cryptocurrency users.